The previous weekend I attended a retreat at Mo Ranch titled “Coping with Chaos” which seemed quite appropriate based upon the times we live in! On Monday morning I had to catch a flight to Dallas to address the Dallas CPA Society that afternoon. On the way to airport, I was listening to several different radio stations, and these were the issues addressed during my 40 minute drive.

What great inspiring thoughts to start my week off! The issue is this is the way we start almost every week, especially when we turn on the radio, TV, or open a newspaper, or log onto the internet. We’re inundated with local, national and international news which makes life, unpredictable, uncertain and unsettling! What we must realize is the fact that since the dawn of time this is the way it’s always been, and this is the way it will always be, as we spend our time under the sun!

Ecclesiastes 1:14 “I have seen all the things under the sun; all of them are meaningless, a chasing after the wind.” “Vanity of vanities – all is vanity.”

The problem we have today is the sheer magnitude, sources and speed of information dumped upon us daily.

What’s the Alternative?

I guess we could choose not to listen to or read the news? We could start the day off writing down and giving Thanks and Blessing for all the gifts we’ve been give? We could choose to simplify our lives and cast out all that is not important? We could be Mindful and live in the moment? We can turn it over and Trust in God!

Retirement in an age of Uncertainty

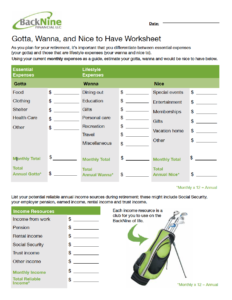

Besides not retiring and simply slowing down or what I call Phased Retirement, I would most definitely suggest that one simply one’s finances. The most effective planning tool, I’ve seen or used in the last 47 years in the financial services industry is the pyramid approach (See worksheet below).

Gotta, Wanna, and Nice to Have Worksheet

Using the Needs, Wants & Wishes Approach to financial planning allows one to determine exactly what one NEEDS to sleep at night and not worry about the volatility and vagaries of the markets. Using Pensions (if one is so blessed), Social Security (hopefully having higher earning spouse delay until age 70 before claiming) and using annuities or CD ladders to cover one’s Essential Expenses while using other assets to cover one’s Wants & Wishes. Thus, in Good Years (Bull Markets) we might take trips to Europe or other exotic sites, but in Bad Years (Bear Markets) we cut back and stay closer to home! Whether we know it or not we’ve taken this approach throughout our lives, especially when one loses one’s job or circumstances dictate cutting back. The real key to taking this approach is the Peace of Mind knowing that one’s Essential Expenses are covered!

Social Security is of paramount importance in taking this approach thus it is absolutely imperative that we make the right decisions as to when & how to claim benefits!

Have a great month,