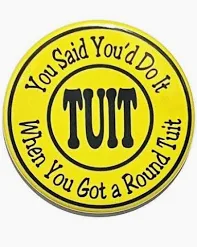

On my desk sits a round poker chip with the word TUIT painted on it.

Whenever someone says, “I’ll get around to it,” I can hand them one.

It usually gets a smile—but it also makes a point.

For decades, Congress has promised to “get around to” fixing Social Security.

And for decades, meaningful action has been postponed.

In today’s hyper-political environment—where agreement between parties in either the House or the Senate has become increasingly rare—solving the pending Social Security shortfall has grown more ominous, not less.

Social Security insolvency is no longer an if question.

It is a when question.

And that “when” is approaching quickly.

The Clock Is No Longer Theoretical

The primary Social Security trust fund used to pay retirement benefits is projected to be depleted as early as 2032. Once that occurs, incoming payroll taxes will still fund benefits—but only at about 80% of scheduled levels.

If Congress does nothing, that translates into an automatic benefit reduction of roughly 20%, applied across the board.

Not gradual.

Not targeted.

Immediate.

With senators serving six-year terms, those currently in office—or running in upcoming elections—will almost certainly be the ones forced to confront this reality. Each year of delay narrows the available options and increases the likelihood of abrupt solutions.

Why This Feels Different This Time

Several forces are accelerating the timeline:

- Higher benefit payouts, including recent legislative expansions

- Fewer workers paying into the system, due to demographics and workforce disruption

- An aging population, drawing benefits for longer periods

- Wage concentration, with more income earned above the payroll tax cap

Social Security depends on a broad base of workers supporting a smaller group of retirees. That balance has been eroding for decades—and now the math is catching up.

Political Reality: Expect a Package, Not a Silver Bullet

In a deeply divided Congress, no single reform stands alone. The most realistic outcome is a combination of changes, designed to spread the impact across generations and income levels.

In my opinion, the most likely package includes:

- Increasing the Amount of Earnings Subject to FICA Taxes

In 2026, wages above $184,500 are not subject to Social Security payroll tax. Raising—or eventually eliminating—this cap would increase revenue, largely from higher earners. - Gradually Increasing the Payroll Tax Rate

The current rate is 6.2% for employees and 6.2% for employers. A slow, phased increase—implemented over many years—could significantly improve solvency without economic shock. - Gradually Increasing the Full Retirement Age (FRA)

Currently, the Full Retirement Age for individuals born in 1960 or later is 67.

I expect this age to rise gradually in the future—but not for those currently over age 55. Individuals nearing retirement would not have sufficient time to adjust their plans, and lawmakers are well aware of that reality. Any increase would almost certainly apply only to younger cohorts and be phased in slowly. - Recalculating the Inflation Adjustment Formula

Cost-of-living adjustments matter, but even modest technical changes to how inflation is measured can materially affect long-term benefit growth.

Together, these measures would allow Congress to claim action while minimizing political fallout—especially if implemented close to a perceived crisis.

What This Means to You

Regardless of how Congress ultimately acts, several truths are already clear:

- Social Security is not going away—but it will change.

The program will continue, but future benefits are unlikely to look exactly like those of prior generations. - Planning assumptions should be more conservative.

Counting on full scheduled benefits—especially for younger workers—may no longer be realistic. - Claiming decisions matter more than ever.

When you claim Social Security can significantly affect lifetime income, particularly in an inflationary environment. - Couples have unique planning opportunities.

Social Security is often a family decision, not an individual one. Coordinated claiming, spousal and survivor benefits, and hedging strategies can materially improve household outcomes when evaluated properly. - This is not a do-it-yourself exercise.

That is why I will continue working with you—and with your clients—to evaluate all available options and make educated decisions based on analysis rather than headlines.

Why 60 Matters

Age 60 represents a critical planning window.

By this point:

- Your earnings history is largely established

- Spousal and survivor benefit strategies can be modeled accurately

- Claiming scenarios can be stress-tested under different policy assumptions

While benefits cannot be claimed until later, the best decisions are made earlier—when flexibility still exists. Waiting too long often turns planning into reaction.

Ideally, this analysis should be completed no later than age 60, before key decisions become locked in.

Final Thought

Every year Congress delays meaningful reform, the Round Tuit becomes harder to hand out.

Early, gradual changes preserve confidence and flexibility. Last-minute fixes tend to be sharper, less thoughtful, and harder to absorb.

The greatest risk is not that Social Security will disappear.

The real risk is assuming nothing will change—until it does.

David P. Zander

CFP Emeritus Board ™

dzander@back9pro.com

260-615-0078