Over the holidays a former associate of mine from Lincoln Financial (an actuary by the way) asked me if I would write a review on his book that he had just published for sale on Amazon. I said absolutely and it came a couple days later in the mail. What a surprise when I opened the box and found a 9 pound, 859 page manuscript titled Another Day in Paradise – The Handbook of Retirement Income! Truth be told, NO, I haven’t read the whole book, but I did peruse it, and it is chockful of everything a financial advisor (CFA) would want to know on a variety retirement income topics from Mortality Tables, Monte Carlo simulations, taxation, inflation, etc. etc.

My question to Jeff was who is your audience? When almost 50% of American’s have no idea of how much they’ll need in retirement nor where will it come from, who would take the time to read, much less understand what he’s written!

Southwest Airlines

I come from the Herb Kelleher school of presentations and business. Herb came up with the idea of an airline, on the back of a bar napkin back in 1966. I had a boss back in 1983 who told me in no specific terms “Dave, every presentation you make, you should be able to put it on the back of a bar napkin and if you can’t, you should stay in the bar until you can.” Pat must have graduated from the Kelleher School of Business as well.

Bar Napkin Approach to Retirement Income

First, you’ll need 2 bar napkins, one for what you’ve got and the other for what you’ll spend it on.

Step 1 – What do you have?

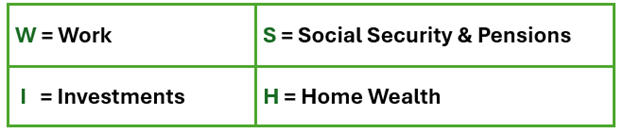

What you do and what you’ve accumulated goes into 1 of these 4 boxes. Take a piece of paper and draw 4 boxes. I call this WISH 4 Income:

W = Work

If you are young, most of your income is generated from work. It’s the greatest asset as it relates to providing income and saving for retirement. If you decide to work in retirement that additional income will and can be used to offset expenses

I = Investments

In this box you’ll need to put everything you’ve accumulated to date. In this box you’ll need to put all your investments, IRA’s, Insurance, Annuities, Rental Properties, Oil & Gas, 401k’s, Roth, etc. etc.

The key is determining how much income you can safely and predictably generate from these assets. A good financial advisor can assist you in this area and most of them work exclusively with the Investment Assets.

S = Social Security & Pension

In this box you will put your project Social Security benefits at Full Retirement Age for both you and your spouse. You’ll also put in any pensions you currently receive or anticipate receiving.

This is where I run a Social Security analysis of what your options are and how best to claim for both you and your spouse. This decision is probably the biggest financial decision most American’s will ever make, thus it’s imperative to look at all options before claiming.

H = Home Wealth

Even though a home is an expense and does not throw off income, it is important to look at in regards to total net worth. Take Current Home Value – Mortgage = Home Equity. For many American’s the HOME is The greatest asset you may have!

Step 2 – What will you need in Retirement?

The easiest way is to determine YOUR NEEDS – YOUR WANTS – YOUR WISHES. (See worksheet below) will help you categorize what your expenses will be.

Step 3 – Determine what your expenses will be, and do you have enough income to cover them?

If there is a shortfall, then you need to either generate more income or cut your expenses. Maybe you’ll need to recategorize NEEDS vs WANTS. Maybe it’s delaying retirement while continuing to work a little longer? Maybe, it’s taking a part time job to cover any shortfall? Maybe it’s creating an income bridge that will allow you to delay claiming Social Security, thus generating a larger check in the future? There are endless possibilities for planning, what you need to do is determine what works best for you!

Coming Next Month, we will discuss the Number 1 Factor which makes all these calculations and conversations more difficult – LONGEVITY – WHAT’S YOUR CHECK OUT DATE!

![]()

Have a great month and never hesitate to reach out to me, if you think I can be of assistance,

David P. Zander

CFP Emeritus Board ™

dzander@back9pro.com

260-615-0078