As we come to the end of another year, I thought it most appropriate to see what changes we’ll see in Social Security for 2026;

Cost-of-Living Adjustment (COLA)

- Benefits will rise by 2.8% beginning January 2026, reflecting the increase in the Consumer Price Index (CPI-W).

- Example: A $2,000 monthly benefit in 2025 will become $2,056 in 2026

- Observation: Many individuals don’t realize that even if you’re not receiving benefits the COLA increases will still be added to your benefits when you do file. Thus, if your 67 and waiting until age 70 to claim benefits, you will be credited with 8% + 2.8% = 10.8% for that year.

Taxable Maximum

- The maximum amount of earnings subject to Social Security tax will increase from $176,100 (2025) to $184,500 (2026).

- This affects both employees and employers, who each pay 6.2% on wages up to the limit (self-employed pay 12.4%)

- Observation: Only 5% of individuals who are working will exceed $184,500 in earnings next year, thus 95% of workers will be paying FICA on all their earned income. An individual maxing out will pay $11,439 and if self-employed will pay $22,878. One summary of tax-progressivity noted that “three-fourths of U.S. taxpayers pay more in payroll taxes than they do in income taxes.”

Full Retirement Age

- For individuals born in 1959, the Full Retirement Age becomes 66 years and 10 months.

- Those born in 1960 or later reach full retirement at 67.

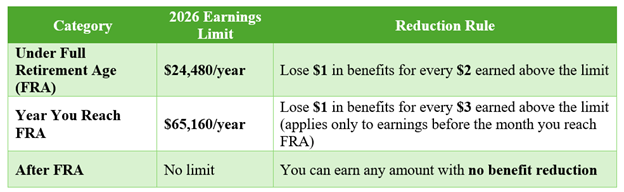

Earnings Test Limits

If you work while receiving Social Security before reaching your FRA, will be subject to;

Observation: As an example if you are 62 years old and decide to retire you’ll be subject to a 30% reduction in benefits for the rest of your life and you’ll be subject to the Earnings Test, thus if your going to continue working and anticipate earning more than $24,480 you probably shouldn’t claim benefits!

Earnings Required for Work Credits

- In 2026, one Social Security credit is earned for every $1,890 in covered earnings.

- You can earn up to four credits per year, requiring $7,560 in total earnings.

- Observation; Let’s say you 4 quarters short of the 40 quarters you need to qualify for your own Social Security benefits, so you take a part time job. Once your total earnings hit $7,560 you’ve earned the 4 credits, even if you only worked 1 month!

Spousal Benefits

- One of the issues which comes up quite often is the desire for the lower earning spouse who has not accumulated 40 quarters to get to that threshold, not realizing that they will eligible to receive the greater of their own benefits or spousal benefits, whichever is greater. Since the formula for Social Security benefits is the highest 35 years of benefits, I’ts highly probable that 50% of the spouses benefits at FRA will be greater!

Happy Thanksgiving!

We tend to take so much for granted in this country, be it our health, our families, our finances, our time and all our other freedoms. It’s not until we lose something of value that we look back with regret over what we’ve lost. Let’s take the time today, this week, this month, this year, this decade, this life to appreciate and give thanks all we’ve been given!

May God Bless you, your families and this country!

David P. Zander

CFP Emeritus Board ™

dzander@back9pro.com

260-615-0078