Last week I had a meeting with a couple and as you can guess, the main topic of discussion was when should he claim his Social Security benefits? Liz retired and claimed on her own record last year and Jim will reach his FRA (66 & 8) this month and plans to retire in May. The #1 concern that people always have when they retire is replacing their paychecks! Jim’s SSA check would be $3,900/mo. now vs $5,200/mo. at 70 so as you can see there is a significant reason to delay if they have other sources of income!

When asked how much they had set aside in retirement accounts he answered a little over $3,000,000. I find it extremely interesting that most American’s, especially those who were raised by depression era parents, are extremely hesitant to use / dip into the principal of their investments! What was the purpose of a retirement accounts? To create income in retirement!!!!! It is so very difficult for individuals to switch from an accumulation mindset to a distribution mindset! That is the very reason I started Back 9 Financial in 2004, on the Front 9 you Accumulate Assets and pay FICA, on the Back 9 you Distribute Assets and claim Social Security!

Hearses Don’t Have Trailer Hitches

I attended a funeral this morning for a fellow parishioner, who passed away on the April 15th at age 90. When they put John in the hearse, I didn’t notice a U Haul behind it. I have another funeral this Saturday and I’m absolutely – positively sure they won’t have one either! Try as one might, we’re not taking anything with you when your time comes.

Granted none of us wants to run out of money, before we run out of time! But, it is an amazing fact that a large percentage of retirees under spend what they could comfortably afford to.

By one estimate, the Silent Generation and baby boomers are set to pass on $90 trillion to younger generations by 2044. Other estimates are more conservative, anticipating $84 trillion or so will change hands.

2 Tips from the Pro;

- Enjoy life – there are No Mulligans

- Give money and experiences to kids and grandkids when they can still say – Thank You!

Don’t Waste a Low Tax Bracket

When I made this statement to Jim and Liz, they were extremely perplexed by what I was talking about, since no one had ever bridged that topic. I said you have a $3,000,000 in retirement accounts, how much is yours? They simultaneously said all of it…………no you or someone will have to pay income taxes on that amount and you have to start taking withdrawals at age 73 based upon ever changing RMD rules. At best you or your heirs might keep 2/3 of it.

When I started in the business in 1975 the top tax bracket was 70% on unearned income and 50% on earned income. One might say that from an historical perspective tax brackets are relatively low. In their case keeping their joint filing income below $383,900 – 24% bracket or $201,050 – 22% bracket gives then a lot of flexibility as to withdrawals.

Wisdom Acquired

With the current market volatility, it creates opportunities to transfer stock positions that one really likes, that have been beaten up over the past couple of months and convert those positions into ROTH IRA accounts. Paying taxes on today’s depressed values in hopes that these stocks / positions greatly appreciate going forward could be one of the best decisions you ever make!

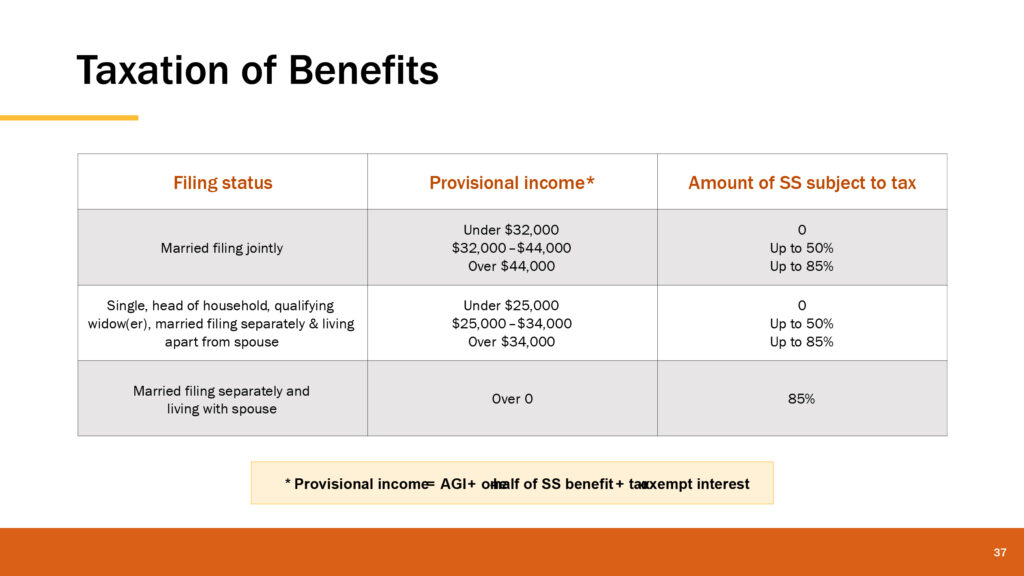

No Tax on Social Security

One of President Trump campaign talking points was eliminating income taxes on Social Security. Granted I would love to not pay taxes on Social Security, but I don’t think that will happen. Who would benefit most by eliminating taxes on Social Security? Wealthier individuals and couples who have other or multiple sources of income. Since 50% of individuals who retire rely on Social Security for > 90% of their income and the average monthly Social Security check is $1,929, they probably don’t pay income taxes anyway! Eliminating income taxes on Social Security will also put more pressure on Social Security reserves now and for years to come.

Personal Prognostication

I could easily see them increasing the thresholds of Provisional Income and indexing those thresholds to inflation going forward.

Why Did They Reduce

I probably get a dozen or so phone calls every year asking why their Social Security benefits were cut? I won’t get into Medicare premiums which have a base rate of $185.00 in 2025, but it is fair to say that many of my clients get the opportunity to pay additional premiums some as much as $628.90 per month based upon their Modified Adjusted Gross Income in 2023. Delaying Social Security benefits can possibly reduce your MAGI thus lowering your Medicare Premiums.

Side Note: Roth IRA distributions are not included in one’s MAGI!

I trust you all had a Great Tax Season and you’ll be taking a well deserved vacation. Some of us however insist on Filing a Tax Extension!