It’s that time of year where we see what the upcoming changes are for Social Security in the coming year! So let’s see;

- 2.5% COLA in 2025 – by the way COLA adjustments affect all folks claiming or not.

- Maximum Earnings subject to FICA taxes – $176,100 up from $168,600

- Earnings Test for those who claim prior to FRA – $23,400 up from $22,320 – thus if one claims prior to FRA you lose $1 in benefits for every $2 one earns above that amount.

- In the year you reach your FRA the earnings test amount is $62,160 up from $59,520 – under this calculation you would lose $1 for every $3 you earn above that number. As an aside if your FRA is May you only need to earn less than $62,160 up to your birthday.

- In order to earn 4 credits on must earn $7,240 in 2025 up from $6,920 in 2024.

- Average check next year will be $1976/mo. for all those currently receiving benefits.

- Maximum check to someone who reaches FRA in 2025 (born April 1958 – 66 & 8 mos.) and claims $4018/mo. That check would be $5,102 if they wait until age 70 to claim.

Social Security Skuttlebut

Eliminating Taxes of Social Security Benefits

President elect Trump campaigned upon eliminating taxes on Social Security benefits, we’ll have to see if this comes to fruition. Prior to 1983 benefits were not taxed, in that year 50% of Social Security benefits were taxed for those who were single making over $25,000 or married over $32,000. In 1993 they added another bracket to the formula which stated that 85% of benefits would be taxed for singles earning more than $34,000 or couples making more than $44,000.

Personal Observation: I would say that the vast majority of my clients pay taxes on 85% of their benefits, since they were referred to me by CPA’s and Financial Advisors, which means they have significantly higher net worths and investable assets than the average American. They are also probably closer the maximum benefits than the average (see above). Eliminating the taxes will increase the Social Security shortfall and will have to be made up somewhere else EVENTUALLY! Since approximately 50% of Social Security recipients rely on Social Security for most if not all of their income, they probably don’t pay taxes on those benefits already.

Eliminating the WEP and the GPO

Earlier this month Congress passed a bill to eliminate the WEP and the GPO provisions within the law, it will be interesting to see if the Senate and the President sign this into law, seeing that it will only increase the Social Security shortfall. Both the WEP (Windfall Elimination Provision) and the GPO (Government Pension Offset) were added by Congress to level the playing field for those who don’t receive a PENSION from a job where they did not pay FICA / Payroll Taxes. Mostly these folks are School Teachers, Fire and Police and Civil employees.

Personal Observation: As a Social Security Nerd, I feel both of these provisions are extremely fair and should not be reversed or eliminated. However, they must be looked at separately;

WEP – Windfall Elimination Provision

The Windfall Elimination Provision comes into play when we have an individual who worked for an entity where they will receive a pension from a job where they and employer did not pay FICA / payroll taxes, but they had another job where they did pay FICA taxes and accumulated their 40 quarters. It is my experience that a majority of teachers, police and firefighters had outside jobs where they did pay FICA taxes and do qualify for benefits. The issue here is the math; Social Security takes the highest 35 years of earnings to determine one’s PIA check at FRA (66 – 67), if they accumulate 30 years of significant earnings the WEP does not come into play, thus they get their full benefits. Since these are side jobs it’s very rare that these individuals will get 30 years of significant earnings.

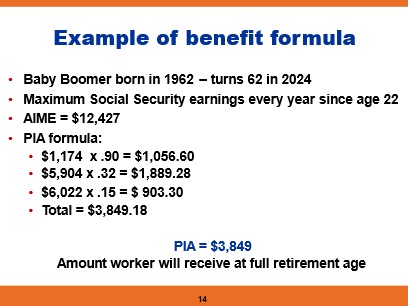

The Social Security formula is extremely progressive, which means those who need it the most, get the most or biggest bang for the buck! So, if I had a side job where I made $1,000 per month you’ll see in the example below that all the earnings will be credited with a 90% benefit!

The Social Security formula is extremely progressive, which means those who need it the most, get the most or biggest bang for the buck! So, if I had a side job where I made $1,000 per month you’ll see in the example below that all the earnings will be credited with a 90% benefit!

Now take a high earner who paid FICA taxes on all their income and will not receive a pension from an exempt entity. Their crediting rate is greatly reduced to either 32% or 15% for the bulk their earnings. Yes, they’ll receive a greater check, but on a percentage basis they will receive much less!

All the WEP does is reduce the crediting rate on the 1st tranche from 90% to 40%. So, take a policeman who had a preadjusted PIA (check at FRA) of $1,000 they would receive $500 per month at FRA. I can make the point that the WEP formula is overly generous to those subject to it! As an aside if the worker has between 20 – 30 years of Significant Earnings the penalty goes down by 5% for each year, so if I had 25 years of significant earning the WEP adjustment is 75% on 1st tranche instead of 40%.

GPO – Government Pension Offset

The GPO deals with SPOUSAL BENEFITS and is a bit more onerous in its calculation. As you know a spouse is eligible to receive spousal benefits and survivorship benefits. Spousal benefits were initially meant to compensate and protect stay at home moms who did not qualify for Social Security. Think of Leave it to Beaver or Father Knows Best (now I’m dating myself). Anyway, the spouse would be eligible to receive spousal benefits when their spouses retired. If my PIA was $3,000 per month they would be eligible to receive $1500 at their FRA when their spouses claims benefits. Thus, in a household where only 1 spouse qualifies for Social Security the other could collect benefits as well. Should the working spouse die, the stay at home spouse would be eligible to receive whatever the deceased spouses benefits were at the time of death. There is a lot more to it, but I’m trying to simplify the case for this example.

Example: Now we have a policeman who will receive a pension from the city of say $6,000 per month and is married to a high earning CPA who maxed out Social Security benefits and reached FRA in 2025 and will receive $4,000 per month. Under normal circumstances the policeman would be eligible to receive $2,000 per month in spousal benefits in addition to keeping his $6,000 per month pension. So they’ll take home $12,000 per month in retirement benefits.

GPO Formula:

We must take 2/3 of whatever the pension is and use that number to reduce spousal benefits. So in this case we take the $6,000/mo. pension x 2/3 = $4,000 offset. So, when the CPA retires the spousal benefits would be $2,000 – $4,000 offset = ZERO spousal benefit. Should the CPA die at age 85 and their Social Security check at death is $6,000 we would once again use the formula: $6,000 – $4,000 offset = $2,000 to policeman.

Should the policeman die before the CPA they would receive whatever beneficiary option they chose upon retirement + keep 100% of their own Social Security benefit, since they did not receive a pension check from a job where they did not pay FICA taxes.

Personal Observation: I can once again make the case that the GPO is extremely fair and should not be eliminated. I do know that eliminating both the WEP and GPO will put additional stress on the Social Security trust fund and future benefits. So, I guess will have to wait and see!

As of right now the Social Security Trust Fund has sufficient funds to pay full benefits thru 2035 and at such time if no changes are made benefits will be reduced for all American’s. I personally don’t see this happening since the #1 objective of every politician is to get re-elected and one does not get re-elected by cutting benefits to 70+ million and counting retirees.

My Take on Possible Solution:

They’ll eventually, hopefully sooner rather than later, get around to tweaking and solidifying the Social Security Trust Fund. I personally see a gradual increase in the FRA from 67 to 70 for folks under age 55, I see an increase in the amount of earnings subject to FICA taxes, there is talk of a donut hole where one would be capped out at $176,000 2025 max limit, but triggered again for earnings over $400,000. I can see a gradual increase in the payroll tax amount from 12.4% to 15% over a period of years which hasn’t been changed since 1993. I can also see a change in the COLA calculation from CPI-W to actual CPI.

I’d like to Thank each and everyone of you for being supportive of my efforts over the last 10 years and want to assure you that I hope to continue to be a valuable resource to you and your clients when the topic of Social Security comes up.

![]()

Have a great Thanksgiving, we truly have a lot to be Thank for!

David P. Zander

CFP Emeritus Board ™

dzander@back9pro.com

260-615-0078