Over the past 2 weeks I’ve had the distinct honor and pleasure to speak at the TXCPA Society meetings in San Antonio, Houston and Dallas. All three sessions were extremely well attended and the audience was truly engaged in the messaging of WHEN and HOW to claim Social Security benefits. The one overriding issue is why wait and what is the breakeven period of waiting vs claiming early?

One of my slides was titled the 3 Stages of Retirement

-

Go Go Years

-

Slow Go Years

-

No Go Years

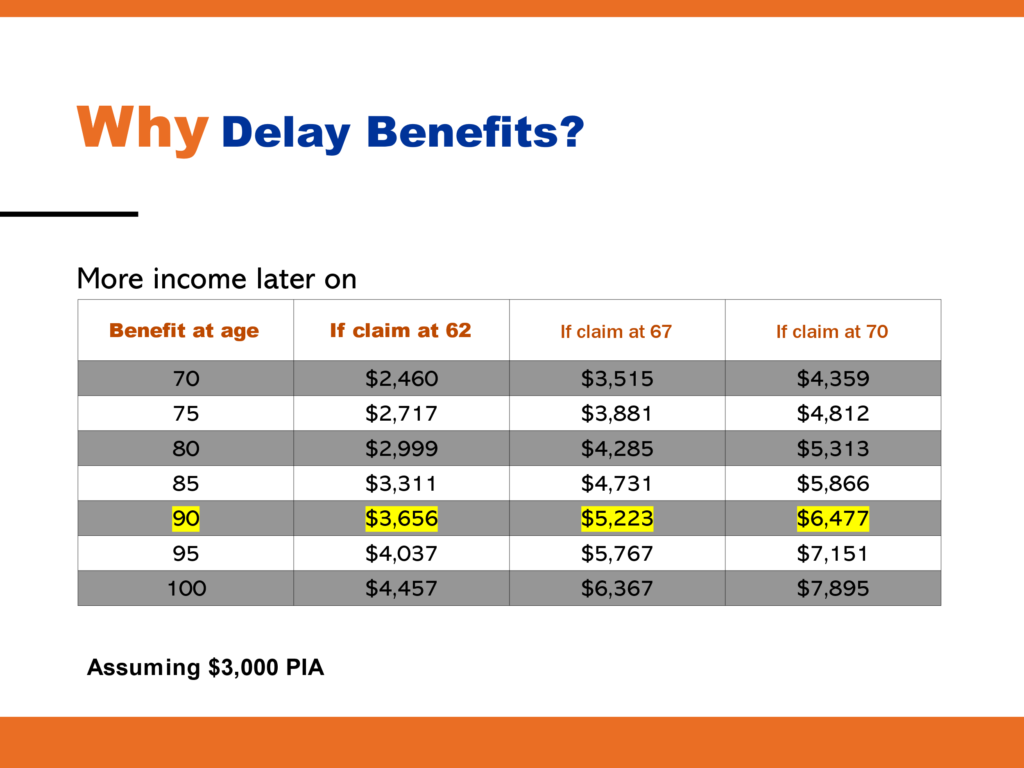

If one lives long enough you will most assuredly experience all 3 phases. Granted we all want to stay in the Go Go Years as long as possible, but as we well know from experience that that is not always the case. Why wait or delay taking money, that you can use it for travel – leisure – family activities? As another slide shows and which I’ve written a lot about – Whatever your check is at age 62 it is DOUBLE at age 70! You worked 40 years to get x, does it make sense to wait 8 more years to get x times 2? When one runs the numbers assuming a 2% annual COLA it takes approximately 10 years to breakeven, but from that point further the difference in monthly checks is dramatic and potentially life altering.

Life Expectancy

In last month’s monthly newsletter (found at Back9Pro.com – Newsletters) I discuss life expectancy issues especially for people once they attain FRA (Full Retirement Age). You can basically assume that there is better than a 50/50 chance that either you or your spouse will reach age 90 and possibly well beyond, thus one needs to realize that the biggest risk in life is living too long, not dying too soon! I’ve attached a slide showing the differences in monthly checks assuming a $3,000 per month PIA (check at FRA) using a 2% COLA. You’ll see that at age 90 the difference between claiming at 62 vs 70 is a monthly difference of $2,821 per month or $33,852 per year.

Slow Go or No Go Years

The question is who cares? I won’t need as much since I’ll be cutting back on my travel & leisure activities since I won’t be as active! Is that true? There is an extended article in today’s San Antonio Express News titled Toll on caregivers for elderly is growing. Several bullet points;

- In 2010 11% of San Antonio’s residents were 65 or older, that rose to 14.2% in 2020

- Average cost of assisted living facility in San Antonio – New Braunfels $41,000 per year which according to Genworth Cost of Care Survey is nearly 50% of median family income in the area

- Cost of adult day care is about $10,300 per year

- In San Antonio metro area has about 46,500 parents and parents in law are living in homes owned or rented by children

I’m not sure where they got their numbers, but we’re spending $8,500 per month for my 97 year old mother in an assisted living center in Madison, Wi. The fact is we’re living longer, more and more baby boomers are or rapidly approaching their retirement years and will experience the 3 phases of retirement. Due to Supply and Demand, healthcare costs will continue to escalate as tens of millions of American’s put tremendous stress upon the overall economy and their personal and their families finances.

Synopsis: No Mulligans!

I think it is fair to say that delaying one’s Social Security or at least having the higher earning spouse delay claiming until 70, (since the surviving spouse inherits the greater of the two benefits upon the death of the other) is a prudent decision. While you are still young and contemplating retirement and Social Security claiming one should look at bridging the gap between 62 and 70 using a combination of several different strategies and resources. One might continue to work full or part time, one spouse might continue working bringing in additional income and keeping employer paid healthcare until reaching Medicare eligibility at 65, one might draw down on qualified plans, etc. The key is there are a number of life and financial options you can explore while in your 60’s, the flexibility to choose might not be an option in when your in your 70’s – 80’s or 90’s.

Planning is the key and that is why I continue to work with CPA’s, Financial Advisors and Corporate HR Departments in education and consultation of When and How to Claim Social Security.

God Bless You All and Your Families over the Holiday’s – be safe and enjoy the moment!