Answer: When is your check out date? Better Answer: What’s your joint lives check out date? If we only knew our check out dates, claiming Social Security would be so easy! But that begs the question, would we really, really, really want to know? I’ll error on the side that we wouldn’t want to know, thus we need to look at all the variables before claiming benefits. This morning I came across article from Think Advisor, as to when you should claim Social Security, these are the 6 points the author mentioned;

- Are you still working

- Do you wish to preserve your portfolio

- What’s the return on your portfolio

- What’s the breakeven between claiming now vs. delaying

- Do you have any unique income needs

- How’s your health

Brother-in-law, neighbor, co workers, friends advice;

- Take it immediately – get it before its gone

- You’ll be dead before 70

My advice is a little bit different;

- How is yours and your spouses health

- What is family longevity history or extenuating circumstances

- Are you still working and plans for future

- What are your financial needs, wants and wishes

- What assets are available (Work, Investments, Social Security, Home Wealth)

- Where are the markets & interest rates, in regards to risk tolerance

- Current tax brackets and qualified plans decisions (RMD issues)

As many Baby Boomers reach or will reach age 62 one of the financial topics most asked is when should I retire? And when should I claim Social Security? This is especially true today when there are daily articles being published on the solvency of Social Security. It all goes back to my initial answer above, how long to you and or your spouse intend to live?

Are You (And Your Clients) Ready for Your 100‑Year Life?

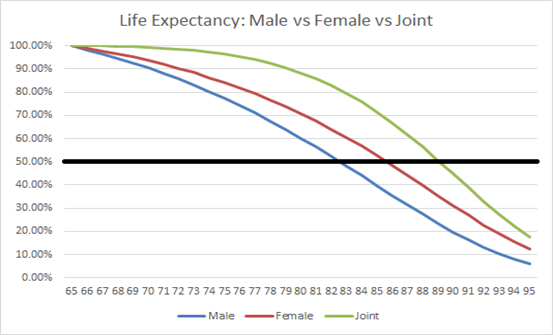

Most individuals are GREATLY, under estimating their life expectancy! A couple turning 65 this year one of them can reasonably expect to live to age 90! That’s a 25 year funding requirement!

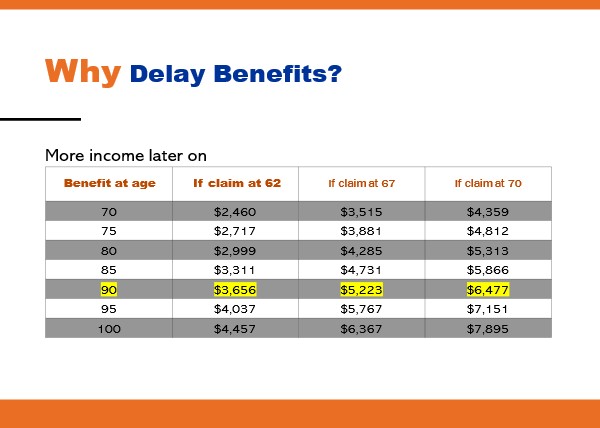

The beauty of Social Security is that one needs to consider it a defined benefit, joint life pension with an annual Cost of Living Adjustment! The longer you live the better it looks.

This assumes a $3,000 (PIA) check at 67 and a 2% annual COLA!

On Monday a received an email from a client who viewed a webcast by Dave Ramsey. He basically appreciated certain aspects of Social Security, but made the comment that if you take the check at age 62, invest it into growth mutual funds you’d be better off than an individual who waits until age 70 to claim. Now all is well and good if the stock market grows at 10% over the next 8 years! I mentioned to my client that last year most stocks indices were down between 20 – 30%, bonds also took a hit due the Fed raising interest rates to fight inflation. Who knows what 2023 and beyond hold in store for us?

I don’t know what the markets will do over the next month, much less the next decade, but I do believe in hedging one’s bet! There are 3 Rules on the Back 9 of Life;

#1 Keep what you got! Don’t give it back, there are No Mulligans on the Back 9

#2 Create an inflation adjusted lifetime income / paycheck

#3 Don’t put all you eggs in 1 basket! Diversify one’s holdings

Many of my clients are blessed with comfortable if not significant retirement portfolios and Social Security is one piece of their retirement income puzzle, but dare I say a significant piece for most. In my personal situation my wife and I receive about $6,000 per month before Medicare deductions from Social Security, it would take a $1,500,000 portfolio with a 4% annual withdrawal to equal that monthly check! My dad died at 87, my mother is 96 and living in a nursing home back in Wisconsin! I’m glad I hedged my bet and delayed Social Security.

Go back to my answer to the title of this newsletter, what’s your check out date?

Always here for you and your clients, friends and family!