Always Retire at the Beginning of a Bull Market – Sequence of Return Risk

If someone had retired in the beginning of 2022, they would have experienced a 9% drop in the DJIA and a 20% loss in the S&P 500. A 60/40 Stock / Bond Portfolio was down 16% for the year. That does not take into account withdraws taken by the retiree to live off of or management charges. Another way of looking at would be an individual had a $1 million IRA account invested in a 60/40 balanced fund and took 5% annual withdrawals from the account or $50,000. Their portfolio value at year end would be approximately $790,000. Now if they wished to take $50,000 out in 2023, that would be a 6.32% withdraw rate. Should we see a repeat performance in 2023 (unlikely but possible) their IRA account balance would be $624,000 at the end of the year. Thus 2 years into their retirement their account would be down 38% and I think it would be safe to save they would be a bit concerned if not running for the exits!

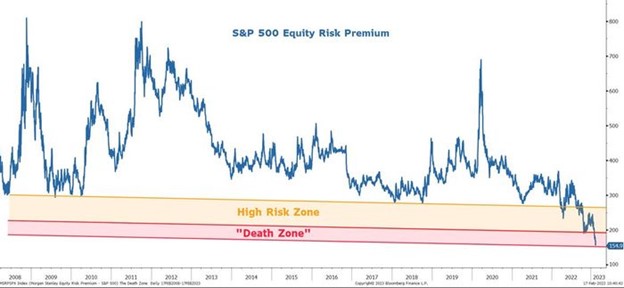

As I write this article the DJIA is down over 500 points and Morgan Stanley had an article this morning saying we could see an additional 26% drop in stock prices this year!

It all starts with a Solid Foundation

I was recently hired by a major publishing company to critique and edit the chapter on Social Security for their Retirement Planning Manual which is used by CPA’s across the country. Social Security was Chapter 5 after Investments and Tax Planning, but should have been right after Cash Flow Planning.

Since late in 1999, I’ve dedicated my career to Income and Distribution Planning and have found using a PYRAMID APPROACH is the most prudent path to a successful retirement outcome.

The Great Pyramids

I’ve not yet been to Egypt but look forward to going and visiting the pyramids. They were constructed around 2500 BC, thus they’ve stood the test of time for almost 5000 years. They were constructed upon solid bedrock with the base much larger than what is seen from ground level. The Willis Tower in downtown Chicago formerly known as the Sears Tower, has a foundation depth of 100 feet with an 18 foot thick concrete mat that supports the 1,451 foot building. New scrapers across the world like the one in Taipei which is 1,667 feet tall has a foundation depth of 101 – 262 feet. With the recent earthquakes that have devastated parts of Turkey and Syria, I wonder what kind of foundations those buildings had?

Financial Aspects – NEEDS – WANTS – WISHES (click pdf worksheet below for your use)

The NEEDS – What keeps you up at night?

What Expenses do you absolutely, positively have to cover on a monthly basis? Now this is different for everyone, and one individuals needs might be another person’s wants, but overall it consists of Food, Clothing and Shelter, etc. They might also include all types of insurance (health, homeowners, car, etc.), it would also include taxes, utilities, charities and possibly an emergency fund. I also call these my GOTTA cover expenses.

SOURCES of INCOME: What you want to do is cover these expenses with GUARANTEED Sources of income. In this category I would put Pensions (if you are fortunate enough to have one), Social Security and the possible use of Annuities, that guarantee a minimum lifetime income. I might put US Government Bonds in this category if they are long term in duration.

Social Security unlike corporate pensions and most annuities has an annual cost of living adjustment (COLA) and as we’ve seen over the last 2 years of 5.9% and 8.7% increase in benefits. When I run an analysis, I project a 2% COLA. As I’ve also written on numerous occasions for the last several years, is that whatever your check is at age 62 it is DOUBLE at age 70, so having a COLA on a higher base is extremely valuable in the long term. What I might recommend here is using a CD bond ladder or short term immediate annuity to create an income bridge, between claiming early or waiting to age 70! The key here is integration of Social Security within your overall financial planning process.

The WANTS – What a Happy Retirement is all about!

This category speaks for itself, these are expenses that you want to cover. That might include vacations and trips, country clubs, entertainment, going out to dinner, helping children & grandchildren, etc. These are expenses that you WANT to cover in order to enjoy life during your retirement years, these are what I call my WANN’A covered expenses. Another way of looking at would be in Good Years you go to Europe, in Bad Years you go the beach or local state park. You cut back and spend your money accordingly! This is how most of us have lived our lives up to this point.

SOURCES of INCOME: This is where I would put Stocks, Bonds, Real Estate, CD’s, Oil & Gas Partnerships, Etc. These are assets that can most definitely out perform Guaranteed Investments, but have they more volatility and uncertainty attached. What happens in many cases, that when markets are good, individuals get spoiled and / or greedy and have no reason to believe that these good times will continue, but invariably there is always a correction!

The WISHES

The Wishes really speak for themselves, that is where one might designate funds for around the world cruises, covering college expenses for grandchildren, or leaving money for children or grandchildren, possibly an endowment for your university, church, etc.

Individualized Planning

The beauty of using the Pyramid Approach is the ability for the individual to determine what are their Needs, Wants and Wishes objectives in relation to their financial assets. As the Pyramids have stood the test of time, it’s been my experience over the last 47 years that this is the most prudent approach to financial planning.

Have a most excellent month and never hesitate to reach out if you think I can be of assistance to you or your clients!